As REITs will always be relevant to the income investor, I have been thinking of how best to increase my investment in REITs again in an environment of increasing interest rates and I decided I should choose REITs which have a better plan or chance to improve their income.

Hedging interest rate risk is very well and good but this only kicks the can down the road because sooner or later, higher interest rates will hit home.

So, having the ability to increase income is still key as to whether a REIT will do well with interest rates increasing over time.

Very importantly, I also decided that it is probably a good idea to diversify more geographically and to reduce my portfolio's reliance on Singapore.

Remember I said this in a recent blog post on Sabana REIT?

However, things will get even more challenging for REITs from here on with interest rates expected to rise further. Industrial REITs here are facing an oversupply of space and a malaise in demand. (Source: History with Sabana REIT and current thoughts.)

So, although I like AIMS AMP Capital Industrial REIT (AA REIT), for example, last month, I decided to initiate a position at 92.5c a unit in Frasers L&I Trust (FLT) which owns logistics and industrial properties in Australia.

The IPO price was 89c a unit and, to be honest, I was waiting for the price to come down from there before buying some.

This was because although there are many things to like about FLT, the distribution yield was on the low side for an industrial REIT.

Unfortunately, the decline I had hoped for did not happen.

So, although FLT's distribution yield of 7+% doesn't seem very attractive when compared to AA REIT's 8+%, I decided that there are enough positive factors such as relatively low gearing and a portfolio of mostly freehold properties in Australia for me to invest in the REIT.

|

| (30 November 2016) |

Other than FLT, I have another new investment in my portfolio.

Again, this has a portfolio of real estate outside of Singapore.

Some readers might remember that I have been waiting for a chance to get into CapitaMall Trust (CMT).

I remember I spent quite a bit of time blogging about it once upon a time: here.

However, from then till now, CMT's unit price did not decline enough to be persuasive, I feel.

Translation: AK is "giam siap" and wants to buy at a much lower price.

What?

You need a translation for "giam siap"?

I blur.

After much consideration, I accepted the offer from Mr. Market to invest in Capita Retail China Trust (CRCT) instead, paying $1.40 a unit.

Just a few months ago in September 2016, CRCT hit a high of $1.66 a unit.

Why the big decline in unit price?

It was probably due to a 10.6% drop in DPU, year on year.

A new tax in Beijing and a weaker RMB were the reasons. NAV also declined by almost 12% to $1.56 per unit.

Offering a higher yield than CMT even now and having ownership of a portfolio of shopping malls in a market with arguably more room for growth (in terms of organised retail activity) than Singapore's, I decided CRCT is probably worth investing in.

After all, a 10.6% decline in DPU doesn't warrant an almost 15.6% decline in unit price unless we are expecting a more severe decline in DPU.

In fact, I think that DPU should recover somewhat as CRCT's non-Beijing malls could pick up the slack over the course of the year.

Having said this, I am reminded of a longer term risk, that land lease in China is typically 50 years and that could explain why Mr. Market demands a higher distribution yield for a retail REIT in China compared to one in Singapore.

I do not know if, like in Hong Kong, land lease could be renewed easily. This is one risk to bear in mind if we choose to invest in CRCT.

|

| (September 2016.) |

This arrangement is similar to Lippo Malls' and I blogged about it before (See blog: here).

A decline in RMB against the S$ could see both gearing and interest expense affected in a bad way.

Although I have said that CRCT would likely see income increasing over time, this is going to be a gradual process.

So, to be prudent, I am keeping my investment in CRCT relatively small.

|

| CRCT's 4Q2016 results. |

Annualising the DPU gives me a distribution yield of 6.75%.

Again, why did I choose to invest in FLT and CRCT in an environment of rising interest rate which would impact their cost of doing business eventually?

You blur?

I also blur.

Xizhimen Beijing. Just next to the train station.

44 comments:

Speaking of Industrial Reits, I was fortunate to dump Cambridge Industrial Thrust in later part of 2015 when things was starting to go downhill. The only Industrial Reits that I have now is MapleTree Logistics Trust, which has properties in China, Japan, Singapore, Vietnam..etc. I am looking to add MLT when Mr market offers me a better price. Have you considered MLT before ?

For China retail Reits, have you considered MapleTree Greater China Commercial Thrust before ? I know that it is not an apple-to-apple comparison with CRCT as MGCCT's properties are partly commercial.

Hi betta man,

A few years back, I looked at two MapleTrees, MLT and MIT. I decided their gearing levels were too high and they had to raise funds. I think they eventually did. I haven't looked at them in detail since.

A key attraction of FLT is the relatively low gearing level which could mean more DPU accretive fully debt funded acquisitions in time to come. It will be a while before I consider another industrial REIT since I made a good size investment in FLT.

Before deciding to invest in CRCT, I did a comparison with MGCCT. I decided that CRCT has more room to improve income compared to MGCCT. There is also the fact that CRCT owns 11 malls which reduces concentration risk while MGCCT has only 3 properties. Having CMA as her parent also makes CRCT more attractive as an investment in the long run.

Hi AK,

Thanks for the inputs. For MLT, there was no rights issue since the day I bought in 2008. But there could be private placements which I am not aware of.

Hi AK,

I am vested in FLT too. With you onboard, my confidence is boosted! :)

Hi betta man,

My memory fails me. It could have been MIT then. :)

Hi DK,

I certainly hope that my reasoning is sound and that FLT will bring home the bacon. :)

CapitaLand Retail China Trust

DPU growth catalysts - Minzhongleyuan and Xinnan

After adjusting our projections for Xinnan and MZLY, as well as for Wuhu (which we expect to continue to be under stabilization), our fair value drops slightly from S$1.60 to S$1.56. CRCT currently trades at 8.3% FY17 forward yield. Having corrected 12% since its 3Q results were announced, CRCT’s price levels appear to offer good value given the DPU catalysts. We upgrade CRCT from a Hold to a BUY.

Source: OCBC Research - 27 Jan 2017

SINGAPORE (Jan 31): DBS Group Research has upgraded CapitaLand Retail China Trust (CRCT) to "buy" from "hold" with $1.60 as it believes the stock is oversold following the recent price correction.

"While CRCT will face headwinds in the form of a weaker average RMB exchange rate, impact from higher property taxes in Beijing and an increase in interest rates over the next few quarters, we believe these risks have largely been priced in," says analyst Mervin Song in a recent report.

Frasers Logistics & Industrial Trust (FLT) recently announced that it had exercised its call option to acquire the Martin Brower property which is located in Sydney, New South Wales, from its sponsor. The total purchase consideration is ~A$58.2m and the property is fully leased to Martin-Brower Australia Pty Ltd for a term of 20 years.

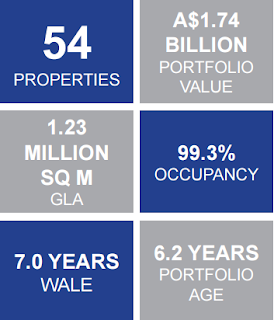

Following this acquisition, FLT’s portfolio will comprise 54 properties with a total GLA of ~1.2m. Its WALE will be lengthened from 6.6 years to 7.0 years and portfolio occupancy will inch up slightly from 99.2% to 99.3%.

With this acquisition, FLT’s aggregate leverage will remain low at 29.8% (versus 28.2% as at 30 Sep 2016). On a pro forma basis, FLT’s DPU for 1QFY16 would increase from 1.41 S cents to 1.44 S cents after this purchase.

We had previously factored in the acquisition of this call option property in our model and hence reiterate our BUY rating and S$1.10 fair value estimate on FLT. The stock offers investors an attractive FY17F distribution yield of 7.3%.

Source: OCBC Research - 2 Dec 2016

Hi AK,

Thank you for all your sharing. I enjoy reading your blog.

May i ask what do you think of Fraser Centerpoint itself? Yield is above 5% at this moment and it is the mother ship of all the Fraser Reits, which offers diversification on all sectors and many countries as well. In addition, there is also some elements of property development.

Best Regards

Hi TFP,

Welcome to my blog. :)

I have not looked at this before but Solace, a guest blogger, did. You might want to search my blog for his article. :)

Hi AK,

Thanks for the thorough analysis. However, with Trump being US president and protectionist, would you think that a trade war would break out between US and China, and increase the risk of investing in stock like CRCT?

Thanks.

Hi AK/Betta Man,

I tabulated the Rights Issues/Private Placements of all the S-REITs in one of my older blog post before.

MIT had a preferential offering in August 2011.

MLT had a Private Placement/Preferential Offering in September 2010 as well as a Rights Issue in July 2008.

Hope this helps

Cheers

UN

Hi Unkown,

Do I think a trade war would break out between USA and China which means an increased risk investing in CRCT? Alamak. I know my bowling ball 4D prediction very accurate this CNY but that was a fluke, I tell you

Hi UN,

Ah, so my failing memory is up to scratch this time. A preferential offering is another phrase for rights issue, if I remember correctly. Thanks for this. :)

FLT reported a DPU of 1.74c for the period 1 October to 31 December 2016, beating forecast by 6.1%. Gearing 29.7%, total borrowings of A$540m. Aggregate portfolio occupancy improved to 99.3% as at 31 December 2016, up from 98.3% at listing. WALE of 6.9 years.

Hi AK,

for Industrial Reit as FLT, what will be the variable that determine their DPU differ lower between two quarters considering this is a new REIT with increasing property/tenant to manage ?

Hi Cory,

As a general rule of thumb, all else being equal, REITs with larger portfolios or AUMs will enjoy economies of scale. Prudent acquisitions will improve DPUs.

A new REIT lacks track record but new is not bad per se. For example, I made good money from investing in Sabana REIT in its first 3 years because its income was more or less guaranteed. With low gearing to boot, it was almost a no brainer then.

Hi Ak, Gong Xi Fa Cai

I also bought Fraser L&I in Nov 16. I liked L& I because there is no debt to be repaid for the next two years hence there is no concern of interest rate hike. Gearing is low and give potential for more future acquisitions. I expect DPU to increase following the recent acquisition.

Hi Investminds,

FLT's numbers are good. I would have liked it even more if the unit price had gone under its IPO price so that I could get in on the cheap. ;p

It touched 89c briefly and went climbing back up. Stubbornly, I waited and waited for another plunge in price. I finally gave up and just bought at what I thought was still a pretty fair price. Can't always get good stuff cheaply.

恭喜发财😊

AK, It is a good entry price. I am waiting for opportunity to long some more lots

Hi Investminds,

All else remaining equal, I don't mind adding to my investment if Mr. Market were to go into a depression. :)

The first six months since FLT’s IPO saw the completion of two development properties ahead of schedule, the acquisition of three Call Option properties as well as proactive lease management.

Leveraging on the positive industrial market dynamics in Australia and the strength of the portfolio, management will continue to pursue growth opportunities for the benefit of our stakeholders.

Management expects FLT to meet the FY2017 DPU Forecast of 6.50 Singapore cents which translates to an attractive yield of 6.84%. We continue to like to long and strong visibility of FLT’s income stream, underpinning its stable and sustainable dividend payments. Its low gearing of 29.7% allows significant headroom to take on debt for

DPU accretive acquisitions. We maintain our BUY rating on FLT.

Lim & Tan

Hi AK, you are solid. You blogged FLT and guess what TA shows that FLT is on an uptrend (above 20, 50D and 200D MA). Huat ah.

Hi Investminds,

I am sure I am just lucky. :)

Hi AK, it is not luck but your skills and years of experience. I would think you've used FA and TA for the correct entry.

Hi Investminds,

Thank you. You are very kind to think so highly of me. :)

Luck always has a part to play in everything I do. This, I am sure. ;)

Reader:

I followed you and bought CRCT. It hit $1.52. I feel like selling. Any advice?

AK:

#1- I didn't issue a BUY call or anything.

#2- To sell or not is up to you.

Frasers Logistics acquiring 7 more assets from sponsor for $174 mil.

http://www.theedgemarkets.com.sg/frasers-logistics-acquiring-7-more-assets-sponsor-174-mil

Hi Teckheng,

Thanks for the update! :)

Reader:

Will you be adding to your investment in AA REIT?

AK:

Nope.

Reader:

Why? I thought you like AA REIT?

AK:

Read this blog. ;)

Based on the pro forma financial effects of the proposed transaction, the distribution per unit of FLT (“DPU”) is expected to be DPU accretive. Portfolio will increase from 54 to 61 properties. GLA increases 10.1% from 1.35 m sq meters to 1.23 m sq meters.

At 1.1x P/B and a yield of almost 6.8%, we maintain our Buy recommendation on FLT.

Source: Lim & Tan Research

FLT's distributable income's 12.1% above forecast at A$26.5 million supported by contributions from the four completed properties in August.

WALE of 6.75 years, gearing of 29.3%, distribution yield of 6.4%.

FLT also has the ability to benefit from the growth of e-commerce.

Reader says...

So what's your take on Soilbuild REIT?

Reduce your holding and switch to perhaps Fraser L&I trust?

- Free hold;

- diversified to Australia in this oversupply scenario in the local industrial space.

- equally strong mgt team (I think the Thai Boss poach back all the ex Australand managers to look after the Australia Properties Group)

- hedge the downward risk (of Soilbuild REIT)

AK says...

I am invested in FLT too. ;)

It is important not to put all our eggs in one basket.

Although we don't like it, sometimes, things do go wrong.

Hello Ak

Catching up on your rather old post here with a BT news saying FLT going into European properties. Can you talk to yourself about this move ? Would this make FLT a better "long-term" REIT?

Also, with this FLT new buy, I scrambled hard to come up with a quantifiable value to FLT NAV & DPU. Hope it wont trouble you much but can you shed some light how FLT new buy changes its NAV/unit & DPU ?

Thanks!

Hi yh,

Received messages from other readers on this too. :)

http://singaporeanstocksinvestor.blogspot.sg/2018/04/frasers-l-trust-and-21-european-assets.html

Reader says...

Crct selling at 9% yield? Wld u buy

I read the slides . It states at 1.50 was 7‰.

I took last year div 0.14/1.43=

9.7%

AK says...

So high ah?

I thought it was lower.

10c DPU per year at $1.43 a unit = 7% yield

Reader says...

Ak ge ge wld u buy crct at 1.41?

AK says...

Read this.

You decide 😛

hi AK

May i know what are your thoughts of the merger of Frasers commercial and Frasers L&I? Both got beaten down by 10% today after the merger gets the go ahead yesterday!

Hi Unknown,

This isn't anything new and has been in the works for a while.

I don't think their unit prices are down because Mr. Market doesn't like the merger.

All the REITs in my portfolio are down today.

It is what it is. ;p

Hi AK, what do you think about their recent venture into logistics? They aim to diverify from retail to business parks and logistics. I tbought it is a good move but the share price drops.

Hi Unknown,

You are referring to CapitaLand China Trust, I guess.

I like the latest development as COVID-19 has made logistics assets even more important than before probably at the expense of assets related to traditional retail models.

The Trust's unit price dropped probably because the private placement unit price is lower than what the Trust was trading at before the announcement was made.

Of course, Mr. Market doesn't care what I think but it doesn't bother me. ;)

Reference:

S-REITS: Are we asking the right questions?

Thanks, AK, for talking to yourself :)

Hi Unknown,

Yes, AK is being mental, as usual. ;)

Post a Comment