When a reader asked me what I thought about Tuan Sing Holdings as it trades at almost 60% discount to NAV, it got me interested enough to take a closer look because this is something I think I understand.

I approached this in a way that is similar to my approach to investing in Guocoland.

Substantial shareholders, the Liem family, and also Koh Wee Meng of Fragrance Group together hold a 60% stake in Tuan Sing.

It is interesting to note that Mr. Koh's purchase price in 2014 was 43c a share and Tuan Sing's NAV per share then was 68c.

Based on its Annual Report for 2016, Tuan Sing's NAV per share grew to 77c and its stock is now trading at a lower price than in 2014.

On the face of it, therefore, Tuan Sing is worth more today and with a lower share price, it is more undervalued than before.

Why is this so?

Tuan Sing's earnings have been in decline and Mr. Market probably doesn't like that.

To top it off, Tuan Sing's gearing level is pretty high and interest cover ratio has also weakened from 14x in 2012 to just 2.2x in 2016.

At the current price level, there seems to be plenty of value waiting to be unlocked but it also seems to be thornier an investment.

We must remember that undervalued could stay undervalued for some time. So, it would be good to be paid while we wait.

Do they pay dividends?

Tuan Sing pays a dividend but it is nothing to shout about. How much? 0.5 cent to 0.6 cent a share.

Assuming a purchase price of 33c a share, we are looking at a dividend yield of 1.5% to 1.8%.

Anyone who buys into Tuan Sing for income has to be mental.

1.5% to 1.8% is lower than the 2.7% dividend yield from Guocoland based on an entry price of $1.83 a share and that was not an ideal investment for income either.

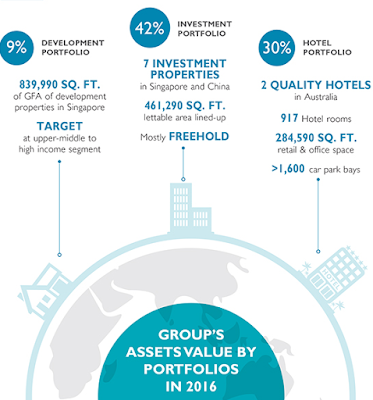

We know that property developers usually have pretty lumpy earnings but I am most interested in the fact that Tuan Sing has a relatively big portfolio of investment properties in Singapore, China and Australia.

Therefore, like Guocoland, Tuan Sing has the potential to become a more attractive investment for income investors if future payouts should increase together with any increase in future cash flow.

Of course, this is somewhat speculative as it is anyone's guess what the Liems have in mind.

|

| Source: Tuan Sing Holdings Limited. |

A big reason probably why Tuan Sing's gearing level is so high, their earnings is much reduced and, consequently, their interest cover ratio is so poor is because quite a big portion of its investment properties are still under development. They have yet to generate any income.

It stands to reason that once Tuan Sing's investment properties are fully completed, once they start generating income, earnings will improve and, significantly, it is worth noting that this will be recurring income which is something investors for income look for.

Of course, Tuan Sing still have development properties to sell but since that business is a relatively small portion of their entire portfolio, if they should sell well, it is the icing on the cake. If they don't sell well, it is not going to be a disaster either.

Cake without any icing, anyone?

Tuan Sing is another asset play and if the valuation is to be believed, they are a pretty heavily undervalued asset play too.

Just like my investments in OUE Limited, Wing Tai, PREH and Guocoland, my investment in Tuan Sing is only a nibble because it could be a long wait before value is unlocked.

In the news this year:

Sime Darby Centre purchased

and

Tuan Sing's earnings tumble 64%.

Related posts:

1. Guocoland analysis.

2. PREH analysis.

3. OUE Limited analysis.

4. Wing Tai Holdings analysis.